How to Start Forex Trading: A Beginner’s Guide

Forex trading, or foreign exchange trading, involves buying and selling currencies to make a profit. As the largest financial market globally, it presents numerous opportunities for traders, from beginners to seasoned professionals. If you’re eager to dive into the world of forex trading, this guide will provide you with essential steps and insights to help you get started. As you embark on this journey, it’s also crucial to choose a reliable trading partner. For those in Argentina, you can explore how to start forex trading Forex Brokers in Argentina to find reputable options.

Understanding the Forex Market

The forex market operates 24 hours a day, five days a week, and involves the trading of currencies like the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), and many others. Unlike stock markets, forex trading does not have a physical location; it is conducted electronically via computer networks. The market is driven by various factors, including economic indicators, geopolitical events, and market sentiment.

Step 1: Educate Yourself

Before starting trading, it’s crucial to equip yourself with knowledge. There are many resources available, including:

- Online courses: Websites like Coursera and Udemy offer courses on forex trading fundamentals.

- Books: Read books like «Currency Trading for Dummies» or «Trading in the Zone» by Mark Douglas.

- Forums and online communities: Engage with forums like BabyPips and Reddit’s r/Forex for tips and guidance from experienced traders.

Step 2: Choose a Trading Style

There are different trading styles in forex, and it’s essential to find one that suits your personality and lifestyle. Some common styles include:

- Scalping: Involves making numerous trades over short time frames to profit from small price fluctuations.

- Day trading: Involves buying and selling currencies within the same trading day, closing all positions before the market closes.

- Swing trading: Focuses on capturing gains over multiple days or weeks by holding positions longer than a day.

- Position trading: A long-term strategy where trades are held for weeks, months, or even years.

Step 3: Open a Trading Account

Once you’ve educated yourself and settled on a trading style, the next step is to open a trading account with a broker. When selecting a forex broker, consider the following:

- Regulation: Ensure the broker is regulated by a reputable authority to ensure your funds’ safety.

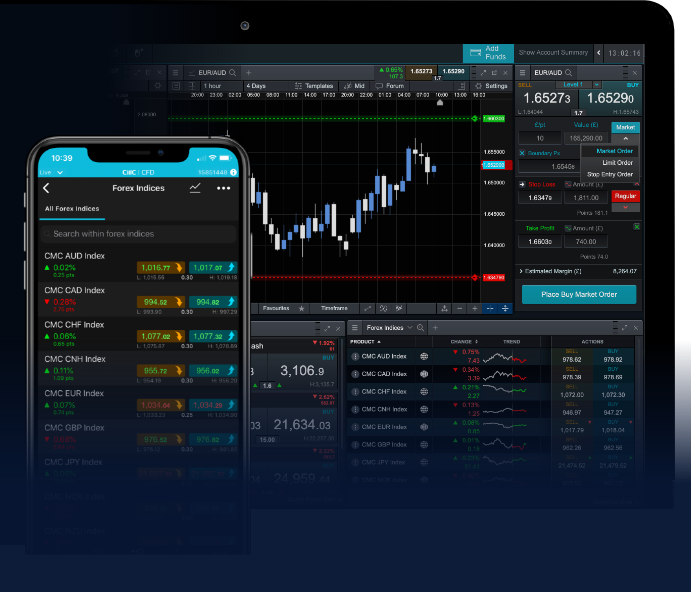

- Trading platform: The platform should be user-friendly and support necessary trading features.

- Fees and spreads: Compare different brokers to find competitive spreads and reasonable fees.

- Customer support: Choose a broker that provides reliable customer support to assist you when needed.

Step 4: Use a Demo Account

Practicing with a demo account is a critical step for beginners. A demo account allows you to trade with virtual money while using real market conditions. This experience helps you understand trading platforms, develop your strategies, and build confidence without risking actual funds. Look for brokers that offer demo accounts to start your practice.

Step 5: Develop a Trading Strategy

A successful trader has a well-defined strategy that outlines when to enter and exit trades. Your strategy should incorporate:

- Technical analysis: Use charts, indicators, and historical data to make informed decisions based on price trends.

- Fundamental analysis: Understand economic indicators, news events, and reports that influence currency values.

- Risk management: Set rules for how much of your capital you are willing to risk on each trade and implement stop-loss orders to protect your investment.

Step 6: Start Trading Live

After you’ve developed your trading strategy and practiced on a demo account, it’s time to start trading live. Begin with a small investment to test your strategies and get a feel for the emotional aspects of trading. As you gain experience and confidence, you can increase your investment.

Step 7: Keep Learning and Adapting

The forex market is dynamic and constantly changing. Continuously educate yourself, analyze your trades, and adapt your strategies based on market conditions. Join webinars, read market analysis, and stay updated on financial news. Remember, even experienced traders can improve and learn new techniques that can enhance their trading performance.

Conclusion

Starting your journey in forex trading can be both exciting and challenging. By following the steps outlined in this guide and committing to continuous learning, you can develop into a successful trader. Remember that patience and discipline are key in trading, so take your time to practice and refine your strategies. With the right approach, the forex market can offer lucrative opportunities for you as a trader.